For iPhone users: You'll need to ensure that you have the latest version of the Bridgeover app from the Apple App Store here. Please check that your iPhone is running at least iOS 13 by navigating to Settings > General > About.

For Android users: Make sure you have downloaded the latest version of the Bridgeover app from the Google Play Store here. If you're still encountering issues, delete and reinstall the app. Restarting your phone may also help.

If you continue to experience difficulties, please reach out to us at support@bridgeover.io or call 1-800-472-4230. Our support team is available Monday to Friday from 9:00 AM to 5:00 PM ET.

When contacting us, please provide the following information:

A description of the issue and/or a screenshot.

The version of the Bridgeover app you downloaded.

The iOS or Android Software update currently running on your phone.

Device information (e.g., iPhone 8, Galaxy S23+).

For iPhone users:

Click on Settings (Gear icon)

Scroll down to find the Bridgeover app icon and tap the arrow on the right

Scroll down to locate the Red Bell icon and tap the arrow next to Notifications

Toggle the switch to the right to enable "Allow Notifications"

For Android users:

Click on Settings

Navigate to Apps and Notifications

Tap on App Info

Find and tap on the Bridgeover App Icon (some devices may require a double-tap)

Tap "Allow Notifications" to turn it on

It's crucial to allow notifications to maximize the benefits of your Bridgeover account. Notifications keep you informed when your Bridgeover account is activated and alert you when your cash flow is low or expected to be low. If your account is in the “red” or “orange” status, you may need to get a cash advance, delay expenses or transfer money from another account to avoid NSF or Overdraft fees.

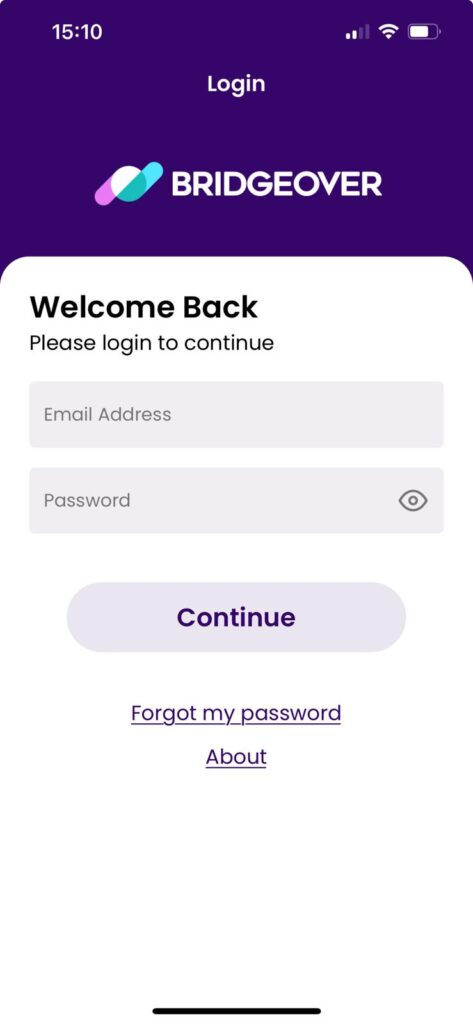

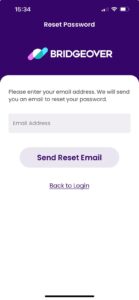

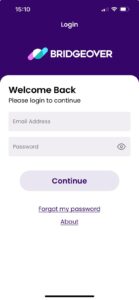

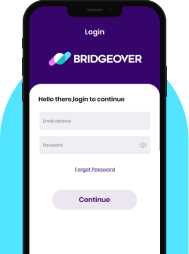

1. Open the Bridgeover app and locate the “Forgot my password” link (displayed below the login fields)

2. Click on the “Forgot my password” link. The next screen will prompt you to enter your email address

3. Enter your email address and submit it. You will receive an email with a link to reset your password.

Please ensure to check your Spam folder if you don't see the email in your inbox. If the reset password link has expired, simply repeat the steps above to successfully reset your password.

If you encounter any difficulties, please email us at support@bridgeover.io or call 1-800-472-4230. Our support team is available Monday to Friday from 9:00 AM to 5:00 PM ET.

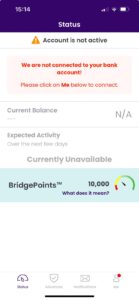

At Bridgeover, we strive to provide the most accurate data possible. On the main screen of the Bridgeover app, you can view the timestamp of the last data update, which indicates when Bridgeover last retrieved your its data.

Keep in mind that your balance might have changed since the last data retrieval by Bridgeover.

Currently, the Bridgeover app is available in English and Spanish. To switch between languages, navigate to the “Me” menu within the Bridgeover app.

We appreciate your understanding as we work towards improving language accessibility for all Bridgeover users.

The requirements for a Bridgeover account are as follows:

Must be employed by an employer who signed up for the Bridgeover program

Must have an Android or an iPhone device

To be eligible for a Bridgeover Cash Advance, your linked account must meet the following requirements:

The Bridgeover service is sponsored by the employer and is available only for employees who work for companies that have partnered with us. If you are already using Bridgeover’s service and quit your job, unless otherwise determined by Bridgeover, you can still use our monitoring services. This means that Bridgeover will monitor your transactions and give you notifications when your balance is low, so you can avoid overdrafting your account or having insufficient funds. However, you will no longer be eligible for cash advances nor will you accrue BridgePoints™.

If your new employer wishes to join us, it would be our pleasure to connect and provide our service. Please let your new employer know that we are available Monday to Friday from 9:00 AM to 5:00 PM ET via email at info@bridgeover.io or via phone at 1-800-472-4230.

The Bridgeover service is sponsored by employers and is available only for employees who work for companies that have decided to take care of their employees financial well being and have partnered with us.

We would love to provide service to your acquaintance. What they would need to do is ask their employer to contact us, and we'll be more than happy to present our solution to them. Our team is available Monday to Friday from 9:00 AM to 5:00 PM ET via email at info@bridgeover.io or via phone at 1-800-472-4230.

Updating your address on your Bridgeover account is easy. Simply email our Support Team at support@bridgeover.io with your address change request. Make sure to attach a document that verifies your new address. Examples of acceptable documents include a driver’s license, state ID, passport, voter ID card, or a recent utility bill.

Once we receive your request and verify the provided documentation, we will promptly update your account with the new address. If you have any questions or need further assistance, don't hesitate to reach out to our Support Team.

In order to check what number is registered on your Bridgeover account, here's what you need to do:

Log onto your Bridgeover app

Navigate to the "Me" section

Select "Profile"

If your registered number is wrong, or not updated, please reach our Support team.

The Support Team is available at support@bridgeover.io. Alternatively, you can call us at 1-800-472-4230. We are available Monday to Friday from 9:00 AM to 5:00 PM ET.

This process ensures that your updated phone number is securely linked to your Bridgeover account while maintaining the integrity of your account's security.

Updating your name on your Bridgeover account is straightforward.

First, gather the necessary documentation to support your name change, such as a certified copy of your marriage certificate, divorce decree, court order for a name change, or another legal document verifying your new name.

Next, email our Support Team at support@bridgeover.io with your name change request and attach the required documentation.

Once we receive and verify your request, we will promptly update your account with the new name.

If you have any questions or need further assistance, feel free to reach out to our Support team.

Open the invite link that was sent to you by Bridgeover or your HR contact OR scan the QR code that was presented to you OR click the Sign Up link on our website.

Complete the onboarding process, including entering the verification code sent via an SMS to your phone and linking your bank account associated with your payroll deposits.

Download the Bridgeover app on your mobile device (iOS or Android).

Log into the Bridgeover app with the password you created during the onboarding and allow notifications.

If you haven’t received an invite link from Bridgeover, please let your HR contact know that you are interested in the Bridgeover benefit, and they will email you an invitation link.

Alternatively, please contact our Support team on Monday to Friday from 9:00 AM to 5:00 PM ET via email at support@bridgeover.io or via phone at 1-800-472-4230.

The verification code will be sent as an SMS to the phone number you provided at the start of the onboarding process.

Please note that if the message remains in your inbox for more than 5 minutes, the verification code will expire. In that case, click the “Click here to resend” link in the registration web app to resend the verification code.

If you continue to experience issues, please contact us at support@bridgeover.io or call 1-800-472-4230. Our support team is available Monday to Friday from 09:00 AM to 05:00 PM ET.

As part of regulatory requirements and to ensure the security of our users, we may request additional information for identity verification purposes. This includes submitting a picture of your government ID. You will receive our request for identification proof via email, which our team will review. This process helps us confirm your identity securely and efficiently.

You’ll want to take the following steps listed below:

Open your camera app.

Place the document or ID on a dark background.

Keep the camera steady and the ID or document in the frame as you take the picture and click “Capture Photo.”

Take a picture of the front and back of the ID.

Here are examples of the types of documentation our team may request if we need additional information:

U.S. State-Issued ID

U.S. State Driver’s License

U.S. Passport

Military Card

Native American Tribal ID with Photograph

Permanent Resident Card or Resident Alien Card (Green Card)

After the documentation review, we will update you on the status of your application. Please remember that any misspellings, inconsistencies in data, and expired identification documents will require additional information from you during the Onboarding process.

Unfortunately, if the Bridgeover team doesn’t receive adequate information to verify your identity, we cannot offer you a Bridge0ver account. If you see your account status is “pending”, you’ll want to double check you have responded to all requests from Support for additional information to verify your identity.

If you have any questions, please email support@bridgeover.io or call 1-800-472-4230. We are available Monday to Friday 09:00 AM to 05:00 PM ET.

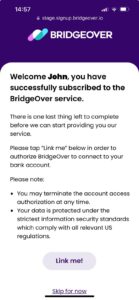

We recommend that you link your bank account during the onboarding process, to avoid delays in the availability of cash advances (depending on your linked account data and activity history eligibility, as detailed in the next question). If you choose to delay linking, you can do it later in the Bridgeover app.

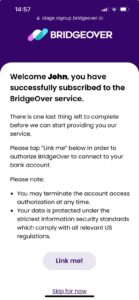

If you choose to link your account during Onboarding by clicking the Invite link, you’ll see this page and click “Link me!” to start the account linking process.

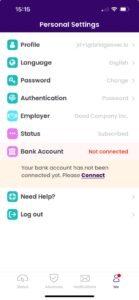

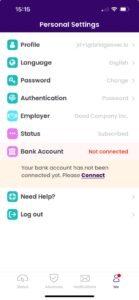

If you skipped this step during Onboarding and want to link your account in the Bridgeover mobile app, do the following steps:

1. Enter your email address and password you’ve created during the onboarding process in the login screen of the Bridgeover mobile app.

2. Click on “Me” on the right side of the bottom menu of the home screen.

3. Click on “Connect” under the red Bank Account tab.

Then you'll be referred to link your bank account using our partner Plaid. From that point, please follow Plaid’s instructions to connect.

Upon registering with Bridgeover and connecting your bank account, we initiate the activation process, which includes conducting Know Your Customer (KYC) checks to prevent fraud and ensure compliance with regulations. Rest assured, any information collected during this process is kept confidential and used solely to provide our services.

Once the KYC checks are completed, we verify that the connected bank account is the one where you receive your paycheck. We then assess your eligibility for an advance based on our requirements, as detailed in the 'Account Eligibility' category..

Typically, this process takes no more than 2 business days.

We recommend that you link your bank account during the onboarding process, to avoid delays in the availability of cash advances (depending on your linked account data and activity history eligibility, as detailed in the 'Onboarding' category). If you choose to delay linking, you can do it later in the Bridgeover app.

If you choose to link your account during Onboarding by clicking the Invite link, you’ll see this page and click “Link me!” to start the account linking process.

If you skipped this step during Onboarding and want to link your account in the Bridgeover mobile app, do the following steps:

Enter your email address and password you’ve created during the onboarding process in the login screen of the Bridgeover mobile app.

2. Click on “Me” on the right side of the bottom menu of the home screen.

3. Click on “Connect” under the red Bank Account tab.

Then you'll link your bank account using our partner Plaid. From that point, please follow Plaid’s instructions to connect.

If you don’t find your bank in Plaid’s filter here, please email us your bank name at support@bridgeover.io and we will verify if your financial institution is integrated with Plaid. If your bank is not Plaid-compatible, unfortunately, we would not be able to serve you at this time.

To be eligible for funding through Bridgeover, you must connect the bank account where you receive your direct paycheck deposit from your employer.

One of the conditions for taking advances is your average balance on payday and the following day. To be eligible for advances, your balance on the day following payday must be at least 30% of your average payroll.

If you have more than one bank account, we recommend connecting all of them so we can assess your eligibility based on the aggregated balance across all accounts.

If you're facing issues, here are some steps to troubleshoot:

If you're using the web app during Onboarding, try refreshing your page. For the mobile app, try deleting and reinstalling it.

Ensure that the username and password you use for bank login during the linking process are accurate.

Double-check that you entered the correct verification code sent to your phone during the account linking process.

If multiple attempts to connect have been made, wait 24 hours before trying again. Repeated attempts might be flagged as suspicious by Plaid or your bank.

If you continue to experience issues, please reach out to us via email at support@bridgeover.io or by calling 1-800-472-4230. Our support team is available Mon-Fri 9:00 AM-5:00 PM ET.

When contacting us for assistance, please have the following information ready:

A description of the issue or a screenshot of the error message.

The version of the Bridgeover app that you downloaded.

The current iOS or Android software update on your phone.

Device information (e.g., iPhone 8, Galaxy S23+).

If linking during onboarding in the web app, mention the browser you're using.

Bridgeover utilizes advanced algorithms and predictive analytics to monitor your account effectively. By analyzing your transaction history, income patterns, and spending behaviors, our system provides personalized insights and alerts in real-time. Through continuous tracking of your financial activity, we detect changes and potential risks, and alert you in advance.

To ensure you receive timely notifications and alerts, we recommend keeping app notifications enabled on your device.

It's essential to note that we prioritize data security and adhere strictly to privacy standards to ensure the confidentiality and integrity of your information throughout the monitoring process.

You are receiving notifications from Bridgeover to keep you informed about important updates, alerts, and reminders related to your account balance and transactions. These notifications are designed to help you stay on top of your finances, including reminders about upcoming payments, low balances, or changes in your account status.

Additionally, Bridgeover may inform you about new features and services available within the app. By keeping you informed in real-time, Bridgeover aims to empower you to make informed financial decisions and better manage your money.

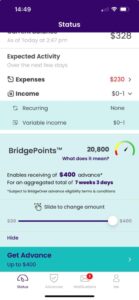

BridgePoints™ are a unique feature of the Bridgeover service, serving as your personal credit reserve. Similar to Emergency Funds, they ensure you have access to funds whenever needed, particularly during emergencies or unforeseen expenses.

You can redeem your BridgePoints™ to take Cash Advances. Each BridgePoint™ represents the right to take an advance of $1 for a period of one day. For example, if you take an advance of $200 for 7 days, you will use 1,400 BridgePoints™. Similarly, if you take an advance of $250 for 10 days, you will be using 2,500 BridgePoints™.

Accumulating BridgePoints™ allows you to take larger advance amounts, more frequently, and for longer periods of time, subject to certain limitations on advance amount and duration.

Based on your BridgePoints™ reserve, you can receive an advance up to 60% of your weekly net salary OR up to 30% of your bi-weekly net salary, limited to a maximum amount of $400.

Earning BridgePoints™ is automatic and part of the Bridgeover service:

Welcome Grant - Upon opening your user account, you will receive an initial welcome grant of BridgePoints™ to kickstart your credit reserve.

Monthly Accumulation - As a user of the service, you'll continue to accrue additional BridgePoints™ every month. These monthly grants are automatically added to your account on the 1st of each calendar month, providing a consistent boost to your credit reserve.

It's important to note that accumulating BridgePoints™ does not require linking your bank account, but you do need to be registered on the Bridgeover service in order to accumulate BridgePoints™. To redeem BridgePoints™ for Cash Advances, a linked bank account is necessary. To ensure eligibility for the Advance service, it's recommended to connect your bank account at your earliest convenience.

At any time, you can easily check your current BridgePoints™ balance within the Bridgeover app, offering transparency and control over your credit reserve.

Remember, the more BridgePoints™ you accumulate, the greater the flexibility to take higher advances for extended periods when the need arises.

Utilizing your BridgePoints to access Cash Advances is a seamless process designed to provide financial support when you need it. Here's a step-by-step guide:

As long as you have an open advance, your BridgePoints balance will be reduced.

Make sure to manage your BridgePoints reserve wisely to ensure you always have access to the cash advances you need. As you accumulate more BridgePoints, you'll have the flexibility to take larger advances for longer periods, providing peace of mind during financial emergencies.

If you find yourself lacking sufficient BridgePoints™, consider adjusting the advance amount or duration to better align with your current BridgePoints™ balance. Remember, advances are collected on the repayment date you've chosen. Even if you're short on BridgePoints™ today, additional BridgePoints™ are credited at the start of each calendar month, potentially enabling you to access the desired advance.

Make sure you smartly manage your BridgePoints™ reserve, so you will always have access to the cash advances you need. The more BridgePoints™ you accumulate, the larger the advances you can take, for a longer period of time, when you need it.

No. Your accumulated BridgePoints™ do not have an expiration.

Once accumulated, they remain valid indefinitely. However, it's essential to manage your BridgePoints™ thoughtfully. We recommend strategically accumulating them, not just for immediate use but also for potential future needs, especially during unforeseen circumstances or emergencies. By maintaining a healthy reserve of BridgePoints™, you can ensure that you have a reliable resource to tap into whenever necessary, providing added peace of mind and financial security.

Remember, the more BridgePoints™ you accumulate, the greater your flexibility and preparedness to address unexpected expenses or financial challenges as they arise.

No, it's not mandatory to connect your bank account to begin accumulating BridgePoints™. You'll start earning points as soon as you register, whether or not your account is linked. However, to access cash advances and enable account monitoring, you will need to have your bank account connected.

Additionally, once you connect your account, we have some regulatory checks we need to perform before allowing you to take your first advance.

Therefore, we emphasize the importance of connecting your bank account at your earliest convenience, for a seamless experience with Bridgeover services.

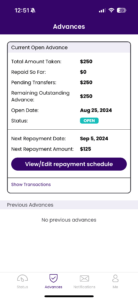

Bridgeover offers a cash advance service to its users. This service helps users manage unexpected expenses or financial emergencies between pay periods. Users can request a cash advance through the Bridgeover app, and once the transfer is complete, the requested amount is deposited directly into their bank account. The available advance amount appears in the app and can be up to 60% of your average net weekly paycheck, with a limit of $400. The advance Bridgeover offers is a short-term solution when you are in need of liquidity.

The outstanding amount of the advance will be collected on your next payday, unless you customize your repayment plan. For more information on the repayment process, please visit the Repayment FAQ category.

A top-up is the option to request additional funds, up to your maximum limit, on top of an existing Cash Advance that you still need to pay back. This feature enables you to access extra funds if you find yourself in need of additional financial assistance beyond their initial cash advance amount.

Example: Suppose your Cash Advance eligible maximum limit is $300. You first decide to take out a $200 Cash Advance. Two days later, you decide to take out an additional $100, which is a "top-up" on the existing Cash Advance. Now, you have an open Cash Advance with an outstanding amount of $300, which you will repay either on your next payday, or as you have scheduled in your repayment plan.

The main purpose of our Cash Advance product (as our name implies) is to bridge over temporary cash deficiency due to emergency or unexpected expenses.

It is not intended to replace the long-term need to match your income and expenses.

To ensure you use you cash advance responsibly and maintain good standing for access to emergency funds for employees, consider the following guidelines:

Borrow Responsibly: Only take the Cash Advance amount you NEED and can reasonably repay within 2-4 pay periods (depends on your payroll frequency). Borrowing more than necessary can lead to unnecessary debt and financial stress.

Budgeting: Create a monthly budget and use our monitoring product to track your expenses and maintain a sufficient balance in your bank account.

Repayment Planning: Ensure you leave sufficient funds in your bank account on payday and on the following 2 business days to repay your Cash Advance balance. Failure to repay on time may affect your BridgePoints™ reserve and may affect your future advance offers.

Notification Settings: Keep your notifications enabled in the Bridgeover app. Important notifications regarding your payment and account status will keep you informed and may require your attention to maintain your Bridgeover account in good standing.

We offer flexibility in repayment, but we expect our customers to use our product responsibly. Following these guidelines will help you avoid financial stress, past-due accounts, and failed payments.

The ACH withdrawal process can take as long as 2 business days to complete. Please note the following:

Timing: The withdrawal timing may vary depending on your bank and its specific ACH processing times.

Funds Availability: Please ensure that you have sufficient funds in your bank account for at least 2 business days following your scheduled repayment date. Weekends and holidays are not included in this timeline, so plan accordingly.

Avoiding Insufficient Funds: Leaving enough money in your account to cover your outstanding balance for 2 business days will help ensure the repayment is successful. This prevents situations where you have insufficient funds and the ACH withdrawal fails, potentially resulting in fees from your bank, an unnecessary use of your BridgePoints™ reserve with possible limitations on future advances.

If you have any questions or need further assistance, please feel free to email us at support@bridgeover.io or call us at 1-800-472-4230. Our support team is available Monday to Friday from 9:00 AM to 5:00 PM ET.

With Bridgeover, you enjoy the benefit of zero interest on cash advances. That’s right, 0% APR. Your employer covers the cost of this benefit, demonstrating their commitment to your overall well-being, including your financial wellness.

Employer-sponsored Benefit: The zero interest rate on cash advances is made possible because your employer subsidizes this benefit. It's part of their effort to support your financial health and provide assistance during times of need.

No Cost to You*: You will not incur any fees or interest charges when requesting and using a cash advance through Bridgeover. This means you can access the funds you need without worrying about additional financial burdens.

* Bridgeover's core service is free, if you pay off your entire advance in one payment. If you break up your repayment into more than one payment, please note that there is a payment fee of $0.95 for each advance repayment starting from the second payment, to cover the additional transfer costs.

Supporting Financial Wellness: By offering zero interest cash advances, Bridgeover aims to help employees manage unexpected expenses or financial emergencies without resorting to high-interest alternatives such as payday loans or credit card cash advances.

No, applying for a Bridgeover Cash Advance does not negatively impact your credit score.

Bridgeover's cash advance application process does not involve any form of credit check or reporting to the credit score agencies. This means that your credit score is not considered during the approval process, and there is no record of the application on your credit report.

Timeline for Cash Advance Deposit: After you accept the Cash Advance proposal in the app, Bridgeover will initiate the advance transfer via ACH. The timing of the deposit depends on when the advance request is initiated:

If the advance request is initiated before 3 pm (CT) or before 4 pm (ET), you will receive the deposit on the same business day.

If the advance request is initiated after 3 pm (CT) or after 4 pm (ET), you will receive the deposit by 11:30 am (CT) or 12:30 pm (ET) on the next business day.

If the advance request is initiated on a non-business day (weekends or holidays), you will receive the deposit on the following business day by 11:30 am (CT) or 12:30 pm (ET).

Banking Procedures: Please note that the actual timing may vary depending on the specific banking procedures of your bank. If you are concerned about the exact timing of the deposit, we recommend double-checking with your bank.

The maximum amount you are eligible for with a cash advance through Bridgeover depends on your payment cycles and your net salary. Here's a breakdown:

Weekly Payment Cycle: You can receive up to 60% of your average weekly net salary*, with a maximum limit of $400.

Bi-weekly Payment Cycle: You can receive up to 30% of your average bi-weekly net salary*, with a maximum limit of $400.

Monthly Payment Cycle: You can receive up to 15% of your average monthly net salary*, with a maximum limit of $400.

Please note that the maximum limit of $400 applies regardless of your payment cycle. This means that even if your salary calculation allows for a higher percentage, the maximum cash advance amount will not exceed $400.

* The average net salary is calculated based on the last 3 net payrolls.

There could be several reasons why you haven’t received the cash advance yet:

Non-Business Day Initiation: If the advance request was initiated on a non-business day (weekends or holidays), the deposit will be processed on the following business day. This delay is due to banking processing times and is a standard practice.

Bank Processing Times: Even if the advance request was initiated on a business day, the processing time by your bank can vary. It may take some time for the funds to be transferred from Bridgeover to your bank account, depending on your bank's procedures.

If you haven’t received the cash advance and none of the above reasons apply, we recommend reaching out to our customer support for further assistance. They can investigate the issue and provide you with more specific information about the status of your cash advance request. Our Support Team is available Monday to Friday from 9:00 AM to 5:00 PM ET at support@bridgeover.io or at 1-800-472-4230.

Repayment for your advance in Bridgeover is due on the next scheduled payday following the receipt of the advance. It's important to note that the repayment process is automatically done on this date unless you have customized it for an alternate date.

If you want to learn more about customizing your repayment plan, please refer to the question "Can I change my repayment date through the Bridgeover app?" for further guidance.

If you take a Cash Advance within 3 days of your next payday, Bridgeover automatically schedules the repayment to occur on your following payday. This simplifies the repayment process and helps ensure that you have sufficient funds available when the repayment is due.

You'll receive a notification or reminder in the Bridgeover app confirming the repayment date and amount. This allows you to plan accordingly and ensures that you're aware of the upcoming deduction from your account.

Flexibility: While the repayment is automatically scheduled for your next payday, you have the flexibility to adjust the repayment date if needed. If you prefer to repay the advance earlier or later, you can make changes to the repayment schedule through the Bridgeover app.

If you want to learn more about customizing your repayment plan, please refer to the question "Can I change my repayment date through the Bridgeover app?" for further guidance.

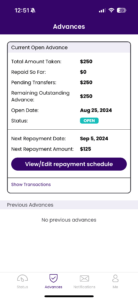

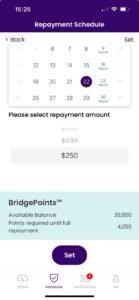

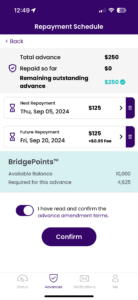

Yes! We offer a Self-serve Custom Repayment feature in our app, allowing you to conveniently manage your repayments. Here's how you can create a custom repayment plan:

1. Access the Advance Screen: Enter the Bridgeover app and navigate to the “Advances" screen. Then, press the "Change repayment schedule" button.

2. Select Repayment Option: Depending on your advance's status, you'll see different repayment options. The first three payment types are automatic, allowing you to simply click to set your payments.

If you prefer to manually set up a repayment schedule, choose the "Manually Setup Repayments Schedule" option and press "Add Repayment".

3. Choose Repayment Date: Select the date that best suits you for the repayment. Please note that there is a maximum time limitation for advances repayment date.

4. Summary of Repayment Schedule: After setting up the repayment date, you'll see a summary screen displaying the next payment date and amount.

In order to see how the repayment schedule has affected your BridgePoints™ balance, please click on the “View/Edit Repayment Schedule” button.

5. Completion: You're all set up! Your repayment plan is now customized according to your preferences.

Important Notes:

Maximum Number of Payments: The maximum number of payments allowed is three.

Total Payment Amount: All of your payments must add up to the outstanding amount of the advance.

BridgePoints™ Usage: Every day of outstanding amount incurs additional BridgePoints™. Use your points wisely and plan to repay your advance promptly to minimize costs.

Payment Deadline: Each Cash Advance has a maximum period of time for repayment. For further clarification on this, please refer to the question "What is the payment deadline for my cash advance?"

By following these steps, you can easily manage and submit payments through the Bridgeover app, providing you with flexibility and control over your repayment schedule.

It's important to note that there is a transfer fee of $0.95 for each advance repayment starting from the second payment. However, if you choose to pay off your entire advance in one payment, you will not be charged any fees. This fee helps cover transfer costs associated with multiple advance repayments.

The payment deadline for your cash advance varies based on your pay frequency:

If you’re paid monthly, your Cash Advance deadline is 2 months.

If you’re paid biweekly/semi-monthly, your Cash Advance deadline is 6 weeks.

If you’re paid weekly, your Cash Advance deadline is 1 month.

The payment deadline represents the timeframe within which you can reschedule your cash advance in full.

Repayment Schedule: While the deadline provides a guideline for repayment, you have the flexibility to adjust the repayment schedule within this timeframe. Bridgeover offers a self-serve custom repayment feature through the app, allowing you to create a repayment plan that aligns with your pay schedule and financial situation.

BridgePoints™ Accumulation: Failure to repay the cash advance by the deadline may result in additional BridgePoints™ usage, which can impact your overall Bridgeover account status and benefits. It's advisable to repay the advance promptly to minimize any associated consequences.

The ACH withdrawal process can take as long as 2 business days to complete from the time of initiation. This remains relevant even if you already see the withdrawal in your bank account. Please note the following:

Timing: The withdrawal timing may vary depending on your bank and the specific ACH processing times.

Funds Availability: Please ensure that you have sufficient funds in your bank account for at least 2 business days following your scheduled payment date. Weekends and holidays are not included in this timeline, so plan accordingly.

Avoiding Insufficient Funds: Leaving enough money in your account to cover your outstanding balance for 2 business days will help ensure the payment is successful. This prevents situations where you have insufficient funds and the ACH withdrawal fails, potentially resulting in bank fees.

If you have any questions or need further assistance, please feel free to email us at support@bridgeover.io or call us at 1-800-472-4230. Our support team is available Monday to Friday from 9:00 AM to 5:00 PM ET.

With Bridgeover, cash advance repayment is designed to be flexible and tailored to your individual cash flow situation. Here's how it works:

Our monitoring product evaluates your ability to comfortably repay the cash advance on your next payday. It considers factors such as your payment history and cash flow to determine whether a payment might create a negative balance in your account.

It’s important to ensure that you have sufficient funds in your bank account for at least 2 business days following your scheduled payment date. Weekends and holidays are not included in this timeline, so plan accordingly.

If you don’t have sufficient funds in your account on the repayment day, Bridgeover will adapt the repayment of your advance to align with your actual cash flow. This means you won’t pay the entire amount of the cash advance all at once, but the repayment will be adjusted based on your available funds*.

*Please be aware that each day of an outstanding amount incurs additional BridgePoints™. Additionally, there is a transfer payment fee of $0.95 for each advance repayment starting from the second payment.

Our AI monitoring product continuously evaluates your cash flow and payment capability, making adjustments as needed to ensure a seamless repayment experience. This proactive approach helps prevent any potential financial strain and promotes responsible borrowing practices.

By offering flexible repayment options and transparent terms, Bridgeover aims to empower users to manage their cash advance repayment effectively while minimizing financial stress.

1. Next Payday Repayment: This is the basic repayment method once you take a new advance. Repayment amount is automatically deducted from your bank account on the next scheduled payday. This ensures convenience and helps you stay on track with your finances.

2. Custom Repayment Schedule: If after you take an advance you realize that the repayment on the next payday will not be possible, you can request, via the app, to create a custom repayment schedule based on your individual financial situation. You can adjust the repayment frequency and amount on the Bridgeover app to better align with your cash flow and budgeting needs.

3. Partial Payments: In cases where you may not be able to repay the full advance amount at once, Bridgeover, on your request, will allow flexibility to make partial payments. This allows you to gradually repay the advance over time, making it more manageable for you.

4. Early Repayment: If you have the financial capability, you can choose to repay your advance earlier than the scheduled payment date. Early repayment can help you save BridgePoints™ and expedite the closure of your advance. To make an immediate repayment, simply contact our support team and ask to pay up.

By providing these flexible repayment options, Bridgeover aims to empower users to manage their cash advance repayment effectively while minimizing financial stress.

It's important to note that there is a transfer cost of $0.95 for each advance repayment starting from the second payment. However, if you pay off your entire advance in one payment, you will not be charged any fees.

There could be a few reasons why you don't have a new cash advance offer available after paying off your previous advance:

Timing Considerations: The ACH withdrawal process can take as long as 2 business days to complete from the time of initiation. Please ensure that you have sufficient funds in your bank account for at least 2 business days following your scheduled payment date. Weekends and holidays are not included in this timeline, so plan accordingly.

BridgePoints™ Availability: If you have utilized all of your available BridgePoints™ or have a negative balance, you may not immediately qualify for a new cash advance offer. However, you will receive a grant of BridgePoints™ on the 1st of every calendar month. Accumulating BridgePoints™ enhances your eligibility for future advances.

Repayment Behavior: Your repayment behavior, including timeliness and consistency in repaying previous advances, may impact your eligibility for a new cash advance offer. Bridgeover prioritizes responsible borrowing and may adjust offers based on your repayment performance.

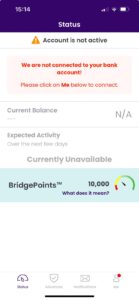

Account Linking Issues: If your Bank Account Status in the app is indicated as RED as shown in the screenshot below, there may be an issue with data retrieval from your bank account. To ensure service continuity, refresh your bank account link connection by accessing 'Personal Settings' and selecting 'Refresh Link.'

Absolutely! Bridgeover understands that unexpected financial situations can cause stress. To help alleviate the pressure, we offer flexibility in repayment.

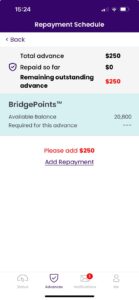

You can split your repayment into multiple smaller payments using our custom repayment schedule feature. Here's how:

Navigate to the Advances tab within the app.

Explore the "Change repayment schedule" option.

Select the amount and date of each payment.

Divide your repayment into up to three smaller payments, aligning with your individual needs and budget, within the offering limitations.

Additionally, if you're in a position to repay earlier than the scheduled date, you can make early payments. Not only does this help reduce stress, but it may also result in savings on BridgePoints™.

It's important to note that if you choose to pay off your entire advance in one payment, you will not be charged any fees. However, there is a transfer cost of $0.95 for each advance repayment starting from the second payment. This charge helps cover transfer costs associated with multiple advance repayments.

If you have any further questions or need assistance, please feel free to contact us at support@bridgeover.io or call us at 1-800-472-4230. Our support team is available Monday to Friday from 9:00 AM to 5:00 PM ET.

We understand that unexpected financial challenges can arise, causing stress and uncertainty. At Bridgeover, we strive to provide flexibility and support to our users during such times.

If you find yourself needing to delay your repayment slightly, we offer options to accommodate your circumstances:

Navigate to the "Advances" screen within the app.

Explore the "Change repayment schedule" option.

Select the date that aligns with your financial situation, within offering limitations, and provides temporary relief from immediate stress.

Please note that the payment deadline for your cash advance varies based on your payroll frequency:

If you’re paid monthly, your Cash Advance deadline is 2 months.

If you’re paid biweekly/semi-monthly, your Cash Advance deadline is 6 weeks.

If you’re paid weekly, your Cash Advance deadline is 1 month.

It's important to consider that delaying your repayment may result in additional BridgePoints™ usage. We recommend weighing your options carefully and reaching out to us promptly for personalized assistance.

If you have any further questions or need assistance, please feel free to contact us at support@bridgeover.io or call us at 1-800-472-4230. Our dedicated support team is available Monday to Friday from 9:00 AM to 5:00 PM ET.

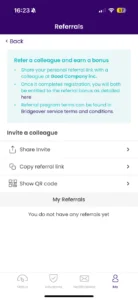

The Bridgeover Referral Program allows users to refer their workplace colleagues to Bridgeover through a unique referral link. By sharing this link, users can help others discover the financial services offered by Bridgeover while earning rewards for themselves.

When you refer a colleague who signs up with Bridgeover using your referral link, you are eligible to receive a cash bonus, which will be deposited directly into your linked bank account. You can refer multiple colleagues, and as long as they successfully sign up, you will continue earning bonuses. Please mind that there is a $500 cap on referral earnings in a calendar year.

Your referred colleague (referee) also benefits from the program by receiving additional BridgePoints™ upon signing up. These points can be used to access Bridgeover’s cash advance services, giving them a financial boost right from the start.

To make a referral:

This program is designed to help you and your colleagues benefit from Bridgeover’s services while offering mutual rewards for participation.

No, Bridgeover's service is provided to you free of charge, thanks to sponsorship from your employer. This means you can access all of Bridgeover's features and benefits without extra cost to you. There's no catch!

Your employer's sponsorship covers the expenses associated with providing Bridgeover's services, ensuring that you have access to valuable financial tools and resources at no cost. This arrangement allows us to support you in managing your finances effectively and responsibly.

While Bridgeover's core service is free, it's important to note that there is a payment of $0.95 for each advance repayment starting from the second payment, to cover the additional transfer costs. Therefore, if you pay off your entire advance in a single payment, you will not incur any fees.

Bridgeover is committed to providing transparent and accessible financial solutions without hidden charges or surprise fees. We believe in empowering our users to manage their finances effectively and responsibly without the burden of additional costs.

There are no interest, no late payment fees, and no subscription or other fees, except in case of split repayments, when you will be charged $0.95 for each advance repayment starting from the second payment. Remember that if you pay off your entire advance in one payment as provided in the advance terms, you will not be charged any fees.

In order to comply with regulations and avoid fraud, Bridgeover collects various types of personal information when you create an account:

Contact and personal information (your name, email address, phone number, and mailing address)

Account balances and bank account information transaction history

Debit Card details

The last 4 digits of your Social Security Number

Information about interactions with our services (such as advance history, alerts, customer support inquiries, and feedback)

Take a look at our Privacy Policy here for additional information. If you have additional questions or concerns about what data we collect and how we share it please contact us at privacy@bridgeover.io.

To ensure the safety and confidentiality of your personal information, Bridgeover implements robust security measures in compliance with federal laws. Our security protocols include advanced computer safeguards and secure file systems, which protect your data from unauthorized access and use.

For a comprehensive overview of our security practices, please refer to our Privacy Policy here. If you have any specific concerns or questions regarding the security of your data, please don't hesitate to reach out to us at privacy@bridgeover.io.

Bridgeover is an AI-powered financial wellness platform that partners with employers to support their employees’ financial health. We provide employees access to interest and fee-free emergency funds up to $400, flexible repayment options, and resources for long-term financial stability.